Tariffs are here. Here are 5 things you can do right now to protect yourself.

By Ben F.

Mar 7, 2025

With tariffs ramping up, prices on a lot of everyday items might start creeping higher.

It’s not exactly the news anyone wants to hear, but there are a few things you can do now to soften the blow and keep your budget on track.

Here are 10 ways to help you brace yourself (without going full doomsday prepper).

1. Cut your auto insurance payment by $400+/year.

Believe it or not, the average American family still overspends by $461/year¹ on car insurance.

(Sometimes it’s significantly more: I saved $1,300/year when I switched)

Here’s how to quickly see how much you’re being overcharged (takes maybe a couple of minutes):

Pull up Coverage.com – it’s a free site that will compare offers for you

Answer the questions on the page

It’ll spit out a bunch of insurance offers for you.

That’s literally it. You’ll likely save yourself a bunch of money.

Here’s a link to Coverage.com

2. See if this company will pay off your credit card debt for you.

If you’ve got $10k+ in unsecured debt (think credit cards, medical bills, etc), you could use a debt relief program and potentially reduce it by around 23% (on average).

Here’s how to quickly see if you qualify for debt relief:

Head to National Debt Relief’s site here

Answer the questions on the page

Find out if you qualify

Simple as that. You’ll likely end up paying less than you owed and could be debt free in 24-48 months.

Here’s a link to National Debt Relief.

3. If you need cash, stop taking out high-interest loans.

So many people take out high-interest payday loans – please don’t do this. If you get into trouble you can typically get a relatively low-interest HELOC (a home equity line of credit)

Essentially with a HELOC, you’re borrowing against the equity you have in your house and use it for whatever you need (much like a credit card).

Typically, you’ll get lower interest rates and more flexible repayment terms compared to traditional loans.

Here’s a calculator you can use to see how much/little you could borrow (link here).

4. Block almost all ads on your desktop, computer or phone.

If you aren’t using an ad blocker yet, I am begging you to try one. I am not exaggerating when I say it will change your life.

A good ad blocker will eliminate virtually all of the ads you’d see on the internet.

No more YouTube ads, no more banner ads, no more pop-up ads, etc. It’s incredible.

Most people I know use Total Adblock (link here) – it’s $2.42/month, but there are plenty of solid options.

Ads also typically take a while to load, so using an ad blocker reduces loading times (typically by 50% or more). They also block ad tracking pixels to protect your privacy, which is nice.

Here’s a link to Total Adblock, if you’re interested.

5. Switch home insurance providers and save (up to $1k+ per year)

Switching home insurance will often save you more than switching auto policies (I've heard of people saving $1k per year by switching).

Here's the home insurance comparison site I typically use: link.

6. Let a company pay your home repair bills for you.

Picture this: your trusty furnace suddenly throws a tantrum in the dead of winter, leaving you shivering and facing a repair bill that could cost you way more than you anticipated.

If you had a home warranty, you could be covered the next time something breaks down. It’s like having a safety net for your home (think plumbing, electrical, appliances, etc).

If you don’t have one yet, Choice Home Warranty is one of the bigger companies out there.

Bonus: home warranty companies usually have qualified, pre-vetted maintenance and repair workers ready to get the job done (which is one less thing to worry about).

If you’re interested just enter your zip code here to find a home warranty plan. It could save you a bunch of money the next time something breaks down.

7. Have someone manage your finances.

99% of people don’t have a financial advisor, and it’s typically a huge mistake.

Sure, you can manage things on your own if you want to, but most people don’t have the time to actually do things right. There are huge benefits to having somebody pay attention to your money all the time.

People with financial advisors tend to beat the market by ~3%/year (according to a 2019 Vanguard Study). That can make a huge difference over time.

But more important: a good advisor will handle ALL of the annoying retirement stuff & bizarro tax implications you would have never thought of

If you don’t know a financial advisor personally, use a comparison site (like WiserAdvisor) and find somebody near you that has good reviews.

Or if you want something easier, here’s a quiz you can fill out that will find an advisor/planner based on your reqs.

8. Put a pause on credit card interest payments until 2027

High-interest credit cards can make it ridiculously hard to get ahead.

But, here’s a credit card that offers a 0% intro APR until nearly 2027 and no annual fee, which means more of your money actually goes toward paying down your balance.

It could be worth considering if you want to break that high-interest cycle. Check it out here.

9. Switch high-interest debt for lower-interest debt.

The average American has ~$6,500 in credit card debt. And almost nothing is more expensive than debt (particularly credit card debt).

If you want to start saving, think about using a personal loan to swap your high-interest debt for lower-interest debt.

The basic idea: find a lower-interest personal loan and pay off your credit card with that loan money. Personal loan interest rates are typically far lower than credit card interest rates.

If you’re interested, here’s a free 3rd party service (Bankrate) where you can compare different personal loan options.

Do your own research, of course. Here’s a link to their site.

10. Get paid for your screentime.

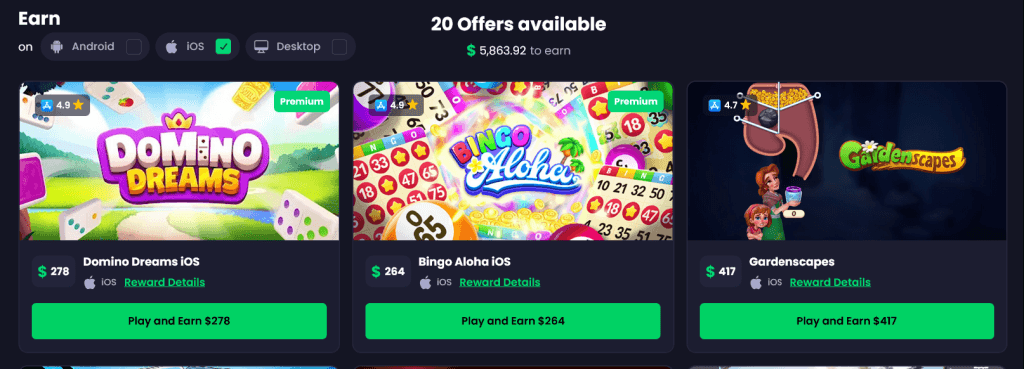

Apps like Freecash will pay you to test new iOS/Android games on your phone.

Some games pay as much as $350 to testers. Here are a few examples right now (from Freecash's homepage):

You don't need any kind of degree or any prior experience: all you really need is a smartphone (Android or IOS).

If you're scrolling on your phone anyway, why not get paid for it?

I've used Freecash in the past - it’s solid. They also gave me a $5 bonus instantly when I installed my first game, which was nice.

11. Stop paying for subscriptions you don't use.

We've all signed up for free trials and forgotten to cancel them. Stop paying for services you aren't using!

Take a minute and get yourself a good cancellation app: I like Rocket Money (link here).

It's an app that will put together a list of your subscriptions so you can pick/choose which ones to cancel.

They also have a premium service that will cancel them for you, if you'd like.

Here's a link (it's free).

12. Use AARP for huge discounts.

You’ve probably heard of AARP, but here’s something I didn’t know until recently: you don’t have to be over 50 to join. While a few perks are reserved for the 50+ crowd, there are still plenty of benefits worth checking out.

They offer discounts on a ton of stuff - dining, travel, gas, groceries, entertainment, etc. So if you like saving money (who doesn’t?), it’s worth checking out.

Membership is ~$16/year, but if you make the most of their offers, it pretty much pays for itself.

Plus, they have some solid resources and tools that can come in handy for things like managing finances or planning for the future.

Not saying it’s for everyone, but if you like getting a good deal, it might be worth a look. Head to their site here.

That’s all (for now).

Thanks for reading!